Can A Self Employed Person Apply For Ppp

On February 22, President Biden announced changes to the Paycheck Protection Program that affect self-employed individuals who applied for a PPP loan after March 3, 2021. This article breaks down the forgiveness process for loan applications made before and after March 3, 2021. Watch the video below for an overview of the changes.

Sole proprietors and independent contractors are finding the PPP loan especially appealing because of the "owner compensation share" or "owner compensation replacement" concept that can grant them full forgiveness, letting them use the funds however they want. Here's how forgiveness works for self-employed individuals.

How sole proprietor PPP loans are calculated

Previously, sole proprietors were able to apply for a PPP loan using their 2019 or 2020 net income as reported on a Schedule C. But changes were made on March 3, 2021 that affected the PPP loan calculation process. There are now two calculations depending on if you have payroll.

Further reading: How to Calculate Gross Income for the PPP

Sole proprietors without payroll costs

If you aren't running payroll, your PPP loan amount will be calculated using your gross or net income as reported on a 2019 or 2020 Schedule C.

To find your average monthly payroll expense, take your gross income (up to a maximum of $100,000) and divide it by 12. Take your average monthly payroll expense and multiply it by 2.5. This will be your PPP loan amount.

Sole proprietors with payroll costs

If you are running payroll costs, your PPP loan calculation requires a few more steps.

Start by taking your gross income as reported on line 7 of a 2019 or 2020 Schedule C. You will then need to subtract any payroll costs as reported on lines 14, 19, and 26. The value you find after subtracting the payroll costs is capped at $100,000. Keep this number handy, it will be used to calculate your owner compensation share or proprietor costs later.

Add in your annual payroll costs for 2019 or 2020 (the same year of the Schedule C you are using). This can be found through your payroll provider or on IRS forms 941, 944, or 940. Remember that you can only include employees whose primary residence is in the United States and their earnings must be capped at $100,000 annualized.

Once you've added your annual payroll costs to the amount taken from your Schedule C, divide by 12 to find your average monthly payroll expense. Multiplying this number by 2.5 will give you your PPP loan amount.

Owner compensation share

Previously, when the PPP loan calculation was based off of net income, the amount you could take as a sole proprietor business owner was called "owner compensation replacement." It was calculated using your net income as reported on line 31 of your Schedule C multiplied by 2.5/12 (or 0.208). For loans after March 3, 2021, this has been changed to be "owner compensation share" or "proprietor costs."

Owner compensation share allows you to apply for forgiveness for 2.5 month's worth of gross profit, without having to spend it on anything. The amount of owner compensation share you're eligible to claim for forgiveness depends on if you are running payroll.

If you are not running payroll, owner compensation share is calculated by multiplying your reported gross income in 2019 or 2020 on your Schedule C by 2.5/12 (or 0.208). This is essentially your entire PPP loan, assuming your loan amount.

If you are running payroll, your owner compensation share is calculated by using your gross income as reported on line 7 minus any payroll expenses reported on lines 14, 19, or 26 of your 2019 or 2020 Schedule C. Multiply this value by 2.5/12 (or 0.208) to find the amount of owner compensation share you can take.

To take the full amount of owner compensation share, you will have to use a covered period of at least 11 weeks. By doing so, you are making yourself ineligible for unemployment benefits (under Pandemic Unemployment Assistance) for the full 11 weeks.

For self-employed individuals that have multiple businesses with PPP loans, you are capped at $20,833 in owner compensation replacement across all loans obtained by all businesses. For example, if you receive $15,000 in owner compensation from one business, you will only be able to receive $5,833 compensation from all other businesses you have an ownership stake in.

Applying for forgiveness

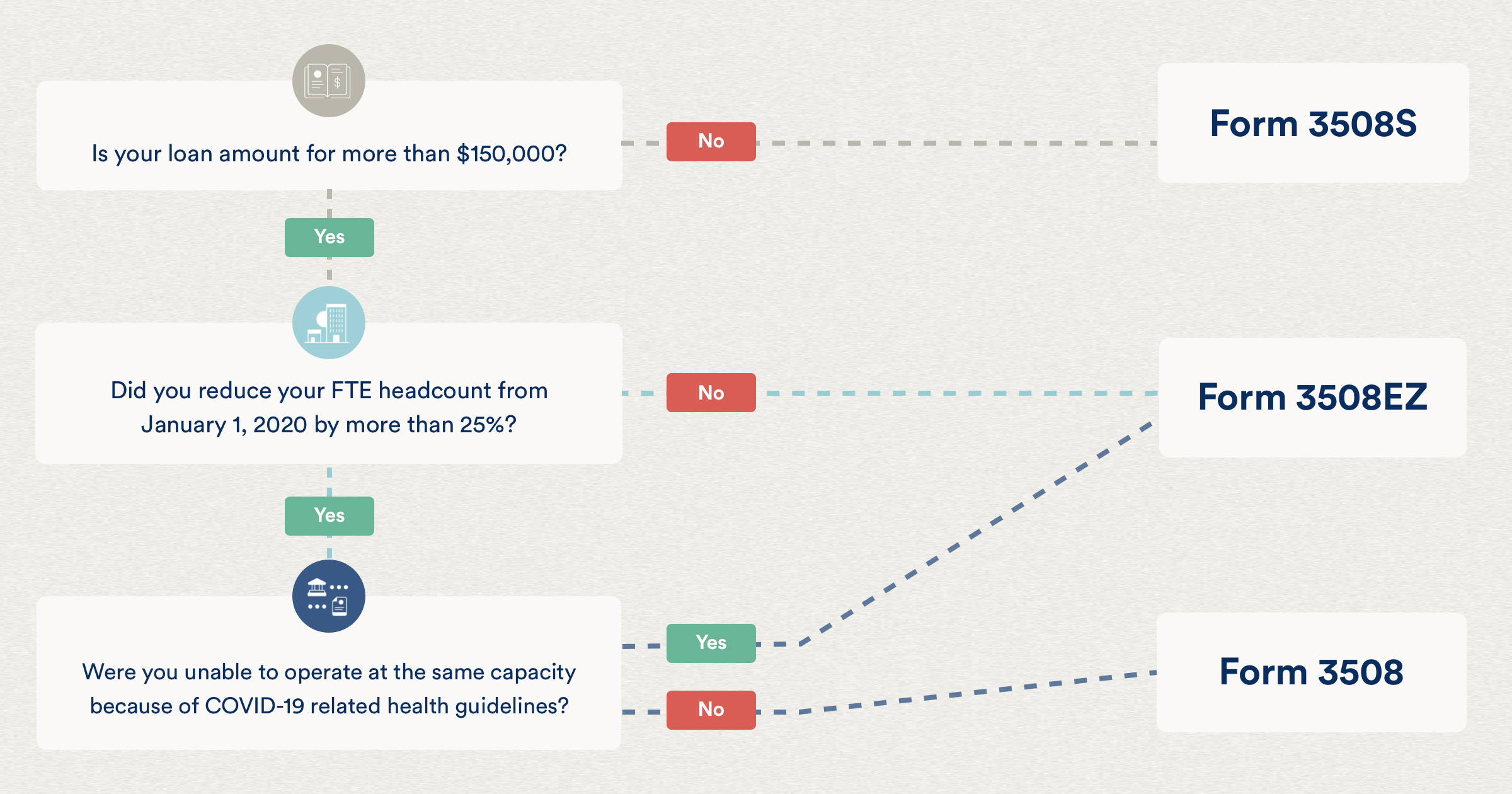

Self-employed individuals can use a simplified forgiveness application called Form 3508S. This form applies to you if your loan amount is $150,000 or less.

If your loan was for more than $150,000, you can use Form 3508EZ so long as you did not reduce your FTE headcount or salaries and wages by more than 25%. Otherwise, you must use the standard forgiveness form.

Most lenders are currently accepting forgiveness applications. Check in with your lender to see what their process is.

You can prepare for a forgiveness application by getting all of your PPP covered expenses calculated. This includes your owner compensation and any of the other eligible PPP expenses.

How Bench can help

Applying forgiveness will be a breeze with a dedicated bookkeeper reviewing all of your monthly expenses on a powerful reporting software. Your loan will be tracked and recorded properly giving you all the information you need. Whether it's for the PPP or making decisions on how to grow your business, Bench's financial reporting gives a clear view of where your money is going. Learn more.

Frequently asked questions

What's the biggest loan I can get?

The PPP limits compensation to an annualized salary of $100,000. For sole proprietors or independent contractors with no employees, the maximum possible PPP loan is therefore $20,833, and the entire amount is automatically eligible for forgiveness as owner compensation share.

Do I need any documentation to prove my expenses for forgiveness?

You will need to prove your expenses for payroll costs and other covered expenses. However, for the owner compensation share, you just need to provide your 2019 or 2020 Schedule C to be able to claim the amount for forgiveness.

If you are applying for PPP forgiveness for a second PPP loan, you will need to provide documentation to prove a 25% decrease in gross receipts between a quarter in 2019 and a quarter in 2020 (or a year over year decrease).

Keep in mind that your lender and the SBA have the right to request and audit your business's financial documents and records, as outlined in your loan agreement. Continue with your ongoing bookkeeping and recordkeeping habits.

Good bookkeeping ensures you stay on top of how you spend your PPP and helps you master your business. Bench's monthly reports equip you with what you need for relief applications and beyond. Learn more about how we can help you stay informed on your business.

Can I get PPP expenses forgiven and deduct them from my taxes?

At this time, the answer to this question is a bit unclear for self-employed individuals. In late 2020, the IRS and U.S. Treasury declared that the PPP would not be considered taxable income, and business expenses paid with the PPP would indeed be tax-deductible. However, they did not clarify how this relates to PPP amounts claimed as OCR or OCS. Because OCR or OCS amounts are used essentially as personal income, we believe it may be taxed as such.

I wasn't in business for all of 2019. Do I still need a Schedule C?

If you're applying for a PPP loan in 2021, you can use your 2020 Schedule C. It does not need to be filed, but it must be reviewed and ready for submission.

Can I use the entire PPP loan to cover my lost income?

Yes, it's possible that your entire PPP loan can be claimed as personal income replacement! You must use a covered period of at least 11 weeks to do so.

I don't have any other business expenses I can claim for forgiveness.

If you cannot claim 100% of your loan as OCR or OCS, and if you don't have any eligible business expenses you can use the PPP funds for, the remaining balance of the loan will need to be repaid according to the PPP loan terms. At 1% interest for 5 years, it's one of the best loan terms you can find, but there is no prepayment penalty if you wish to pay it all off early.

Can I get home office expenses forgiven?

Yes! As long as they fit within the categories of utilities, rent, and mortgage interest, home office expenses can be forgiven. You can review what you need to know in our post on Home Office Deductions and the PPP.

More COVID-19 resources

Need more information on PPP loans?

- Paycheck Protection Program (PPP) Loans Resource Hub for Small Business

- When Can I Submit My PPP Forgiveness Application?

- How to Appeal a PPP Loan Review

- How the PPP, EIDL, and PUA Work Together

Looking for other relief programs?

- The EIDL is Back: What You Need to Know

- The Top (Lesser Known) COVID-19 Small Business Relief Resources

- Unemployment Benefits and the CARES Act

- A Guide to SBA 7(a) Loans for Small Businesses

Can A Self Employed Person Apply For Ppp

Source: https://bench.co/blog/operations/ppp-forgiveness-contractors-sole-props/

Posted by: lowefeliked.blogspot.com

0 Response to "Can A Self Employed Person Apply For Ppp"

Post a Comment